Exclusive look at High NA, ASML’s new $400 million chipmaking colossus

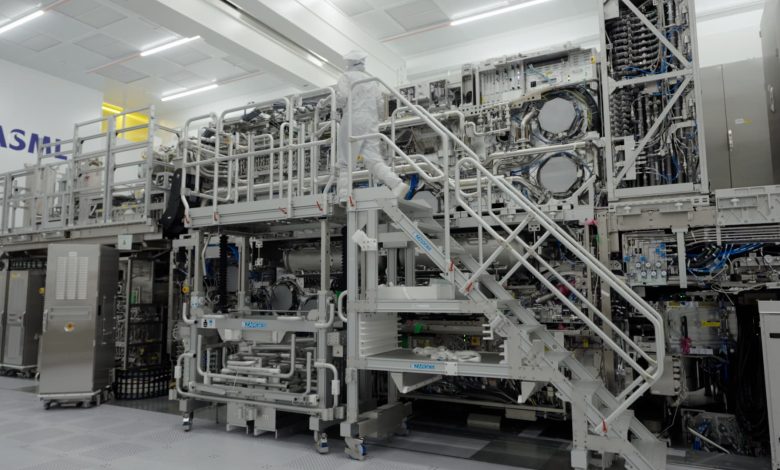

Behind highly secured doors in a giant lab in the Netherlands, there’s a machine that’s transforming how microchips are made. ASML spent nearly a decade developing High NA, which stands for high numerical aperture. With a price tag of more than $400 million, it’s the world’s most advanced and expensive chipmaking machine.

CNBC went to the Netherlands for a tour of the lab in April. Before that, High NA had never been filmed, even by ASML’s own team.

Inside the lab, High NA qualification team lead Assia Haddou gave CNBC an exclusive, up-close look at the High NA machines, which she said are “bigger than a double-decker bus.”

The machine is made up of four modules, manufactured in Connecticut, California, Germany and the Netherlands, then assembled in the Veldhoven, Netherlands, lab for testing and approval, before being disassembled again to ship out. Haddou said it takes seven partially loaded Boeing 747s, or at least 25 trucks, to get one system to a customer.

The world’s first commercial installation of High NA happened at Intel‘s Oregon chip fabrication plant, or fab, in 2024. Only five of the colossal machines have ever been shipped.

They’re now being ramped up to make millions of chips on the factory floors of the few companies that can afford them: Taiwan Semiconductor Manufacturing Co., Samsung and Intel.

High NA is the latest generation of ASML’s Extreme Ultraviolet, or EUV, machines. ASML is the exclusive maker of EUV, the only lithography devices in the world capable of projecting the smallest blueprints that make up the most advanced microchips. Chip designs from giants like Nvidia, Apple and AMD can’t be manufactured without EUV.

ASML told CNBC that High NA will eventually be used by all its EUV customers. That includes other advanced chipmakers like Micron, SK Hynix and Rapidus.

“This company has that market completely cornered,” said Daniel Newman of The Futurum Group.

High NA chipmaking machine in Veldhoven, Netherlands, on April 24, 2025.

Magdalena Petrova

CNBC asked CEO Christophe Fouquet what’s stopping ASML from setting the price of its machines even higher. He explained that as machines advance, they make it cheaper to produce the chips themselves.

“Moore’s law says that we need to continue to drive costs down,” Fouquet said. “There is a belief that if you drive costs down, you create more opportunity, so we need to be part of this game.”

Two major customers have confirmed that High NA has shown big improvements over ASML’s previous EUV machines. At a conference in February, Intel said it had used High NA to make about 30,000 wafers so far, and that the machine was about twice as reliable as its predecessors. At that same conference, Samsung said High NA could reduce its cycle time by 60%, meaning its chips can complete more operations per second.

‘A very risky investment’

High NA can drive chip prices down because of these improvements in speed and performance. High NA also improves yield, meaning more of the chips on each wafer are usable.

That’s because it can project chip designs at a higher resolution. High NA uses the same process as EUV machines but with a larger lens opening that allows for projection of smaller chip design in fewer steps.

“High NA means two things. First and foremost, shrink. So there’s more devices on a single wafer,” said Jos Benschop, ASML’s executive vice president of technology. “Secondly, by avoiding multiple patterning, you can make them faster and you can make them with higher yield.”

Benschop joined ASML in 1997, two years after it became a publicly traded company. Benschop then helped drive the decision to go all in on EUV. The technology took more than 20 years to develop.

ASML executive VP of technology Jos Benschop gave CNBC’s Katie Tarasov a look at High NA chipmaking in Veldhoven, Netherlands, on April 24, 2025.

Magdalena Petrova

“We barely made it. I think sometimes people forget that,” Fouquet said. “It’s been a very risky investment because when we started, there was no guarantee the technology would work.”

By 2018, ASML proved the viability of EUV and major chipmakers started placing big orders for the machines. The idea, which seemed impossible to many two decades ago, was to create large amounts of tiny rays of extreme ultraviolet light, projecting it through masks with increasingly small chip designs, onto wafers of silicon treated with photoresist chemicals.

To create the EUV light, ASML shoots molten tin out of a nozzle at 50,000 droplets per second, shooting each drop with a powerful laser that creates a plasma that’s hotter than the sun. Those tiny explosions are what emit photons of the EUV light, with a wavelength of just 13.5 nanometers.

About the width of five DNA strands, EUV is so small that it’s absorbed by all known substances, so the whole process has to happen in a vacuum. The EUV light bounces off mirrors that aim it through a lens, much like how a camera works. To solve for EUV getting absorbed by mirrors, German optics company Zeiss made specific mirrors just for ASML that are the flattest manmade surfaces in the world.

ASML’s older generation DUV machines use less precise rays of deep ultraviolet light with a wavelength of 193 nanometers. ASML still makes the machines — competing against Nikon and Canon in Japan on DUV — but it is the only company in the world that’s succeeded at EUV lithography.

The Dutch company began developing the $400 million High NA machines around 2016. High NA machines work the same as DUV, with the same EUV light source. But there’s one key difference.

High NA stands for high numerical aperture – meaning it has a larger lens opening, increasing the angle at which the light is captured by the mirrors. More light coming in from steeper angles allows High NA machines to transfer increasingly small designs onto the wafer in one step. By comparison, lower NA machines require multiple projections of EUV light, through multiple masks.

“When the number increases, it gets very complex process-wise and the yield goes down,” Fouquet said.

Resolution improves as NA increases, bringing down the need for multiple masks and exposures, saving time and money. The cost of the High NA machine, however, goes up.

“The bigger the mirror you have to use and therefore the bigger the system,” Fouquet said.

These machines also take up a huge amount of power.

“If we don’t improve the power efficiency of our AI chips over time, the training of the models could consume the entire worldwide energy and that could happen around 2035,” Fouquet said. That’s why ASML has reduced the power needed per wafer exposure by more than 60% since 2018, he said.

ASML’s Assia Haddou shows CNBC’s Katie Tarasov a High NA chipmaking machine in Veldhoven, Netherlands, on April 24, 2025.

Magdalena Petrova

China, tariffs and U.S. growth

ASML is known for its groundbreaking EUV machines, but its older DUV machines still made up 60% of business in 2024. ASML sold 44 EUV machines last year, with a price tag starting at $220 million. DUV machines are far cheaper, ranging from $5 million to $90 million, but ASML sold 374 of the legacy machines in 2024.

China is a major buyer of those DUV systems, making up 49% of ASML’s business in the second quarter of 2024. Fouquet told CNBC this peak in sales to China came because of a “huge backlog” in orders that ASML wasn’t able to fill until last year. He said business in China should be back to the “historical normal” of between 20% and 25% in 2025.

U.S. export controls prevent ASML from selling EUV to China. It’s a ban that started under the first Trump administration. Newman of The Futurum Group said it’s a “real long shot” that China could develop its own EUV machines, instead making devices like smartphones using the most advanced chips possible with DUV.

U.S. concern over advanced tech making its way to China has accelerated amid the generative artificial intelligence race. That boom has also sent chip stocks soaring, including ASML’s, which hit an all-time high in July.

ASML’s share price has declined more than 30% since, as the chip industry faces key uncertainties such as President Donald Trump’s tariffs.

Benschop told CNBC that ASML simply doesn’t know how tariffs will impact the company. With about 800 global suppliers, tariff implications for ASML are complex.

Making a single High NA machine requires many steps of imports and exports. The machine’s four modules are made in the U.S., Netherlands and Germany, then they’re shipped to the Netherlands for assembly and testing, where they’re disassembled again for shipment to chip fabs in places like the U.S. or Asia.

For years, Asia has made up more than 80% of ASML’s business. The U.S. share sat around 17% in 2024 but is growing fast. ASML has 44,000 employees globally, and 8,500 of them are based in the U.S. across 18 offices.

Many of ASML’s 2024 High NA shipments went to Intel, which is building new fabs in Ohio and Arizona. The U.S.-based chipmaker has struggled in recent years, but Fouquet said that Intel remains a “formidable partner” for ASML and that it’s “very critical” for U.S. semiconductor independence.

Taiwan-based TSMC is far ahead of Intel in advancing chip nodes. CNBC recently visited TSMC’s new fab north of Phoenix, which is now in volume production. As the most advanced chip fab on U.S. soil, the need for High NA there will likely come soon.

ASML, meanwhile, is building its first U.S. training center in Arizona. Fouquet told CNBC it will open in the “next few months” with a goal of training 1,200 people on EUV and DUV each year. It’s “a capacity that will not only meet what is needed in the U.S., but will be used also to train even more people worldwide,” he said.

The Dutch company plans to further increase the numerical aperture on its next machine, Hyper NA.

Fouquet told CNBC that ASML has some draft optical designs for this next machine, and that, “it’s not necessarily a difficult product.” He expects the need for Hyper NA to come “between 2032 and 2035.” He wouldn’t speculate on price.

For now, ASML is focused on meeting demand for High NA. It plans to ship at least five more systems this year and ramping to a production capacity of 20 machines in a few years.

Watch the video to see High NA in action.