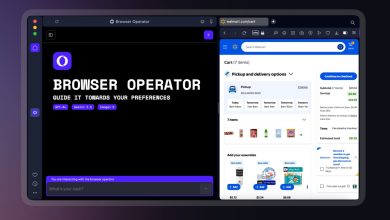

AI cloud provider CoreWeave files for IPO

CoreWeave CEO Michael Intrator appears on CNBC on July 17, 2024.

CNBC

CoreWeave, a company that provides cloud-based Nvidia graphics processing units to Meta, Microsoft and other businesses, on Monday filed to go public on the Nasdaq under the ticker symbol “CRWV.”

The company had a $863.4 million net loss on $1.92 billion in revenue for 2024, according to the company’s prospectus. Revenue was up 737% year over year.

Hedge fund Magnetar controls 7% of CoreWeave’s voting power, while Nvidia has 1%, the filing shows.

Originally known as Atlantic Crypto, New Jersey-based CoreWeave got its start in 2017 by offering infrastructure for mining the Ethereum cryptocurrency. After digital currency prices fell, the company bought up additional GPUs, and it changed its name to CoreWeave, with an increasing focus on graphics rendering and artificial intelligence.

“We quickly started getting inundated with introductions to businesses dependent upon GPU acceleration with a common pain point: legacy cloud providers make it extremely difficult to scale because they offer a limited variety of compute options at monopolistic prices,” co-founder and CEO Brian Intrator wrote in a 2021 blog post.

CoreWeave quickly gained popularity after OpenAI released ChatGPT, because it could quickly provide GPUs to companies that needed them. Microsoft, whose Azure cloud unit has supplied computing power to OpenAI, started working with CoreWeave in 2023 to meet OpenAI demand. In 2024, 62% of CoreWeave’s revenue derived from Microsoft.

At the same time, Microsoft represents competition, as do Amazon, Google, Oracle, as do smaller providers such as Crusoe and Lambda.

This is breaking news. Please refresh for updates.